A Breakdown of Republicans' Shoddy Property Tax Plan

Dear neighbor,

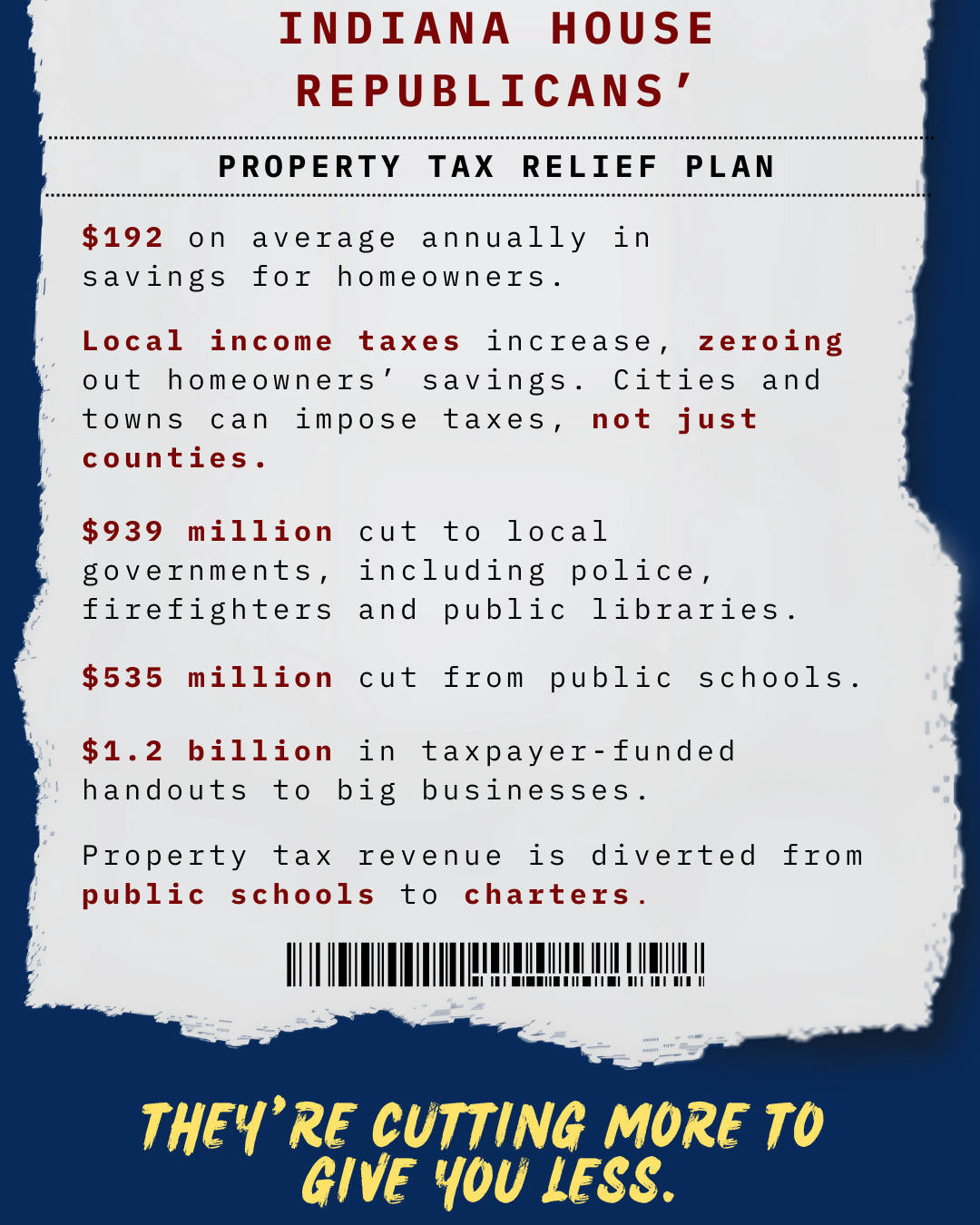

This week, House Republicans unveiled their 368-page proposal for property tax relief. The proposal includes tax breaks for big businesses, increases in local income taxes, little relief for homeowners and diverting money to charters.

Because transparency is a critical part of this process, the below newsletter breaks down where this proposal (Senate Bill 1) stands as of 4:00 p.m. today, April 9.

Here’s a breakdown of how their proposal may impact your 2026 property tax bill:

No Significant Savings for Homeowners

Homeowners will get an average property tax credit of $192 each year, but this isn’t the same for everyone. Some homeowners will receive less.

Seniors of a fixed income and disabled veterans get an additional $150. Partially disabled veterans get an additional $250.

Eliminates the Homestead Standard Deduction by 2030. This deduction lowers your property’s assessed value by 60% or $45,000, whichever is less.

Eliminates the credit for first-time homebuyers, which was included in the Senate property tax plan.

Changes the eligibility thresholds for the Over 65 Circuit Breaker Credit and Deduction. More seniors qualify but the amount they save stays the same.

No relief for renters.

Increasing Your Local Income Taxes

Zeroes out the savings homeowners receive on their property taxes with increases in local income taxes.

Cities and towns could impose local income taxes at a maximum rate of 1.2%. Currently, only counties impose an income tax.

Raises the maximum amount of local income taxes a county can impose from 2.5% to 2.9%.

Cuts to Local Services

Local governments would lose $938.6 million over the next three years.

This means local police, firefighters, public libraries and other services are at risk. Fire chiefs have shared they’ll have to close fire houses or let firefighters go if this proposal passes.

Our community, Lake County, would lose $193 million by 2028.

Public schools would lose $534.8 million in the next three years: $130.4 million in 2026, $146.8 million in 2027 and $266.9 million in 2028. This means our schools will struggle to pay teachers, class sizes will get bigger and students won’t get the quality education they deserve.

Tax Breaks for Big Businesses

Eliminates taxes on business equipment (business personal property). Big businesses get a tax break of $1.2 billion, since millions of dollars in equipment will eventually be tax-free.

Homeowners continue footing the bill for big companies. As of 2024, homeowners were paying 58.4% of Indiana’s property tax revenue, while commercial and industrial companies paid 39.3%.

Hoosiers will be asked to shoulder more of the tax burden for their communities. Businesses don’t pay local income taxes. With the elimination of business personal property taxes and the growth of local income taxes, you’ll be paying a bigger share of the pie while getting fewer services.

Diverting Dollars from Public Schools to Charters

Includes portions of Senate Bill 518, which diverts money from your local public schools to charters.

Corporations and charter school CEOs are the winners of this proposal since they get massive new benefits while homeowners get little. Homeowners will save some money, but other tax increases balance out potential savings. Our communities will receive massive cuts, impacting the services they provide.

If you have any questions, thoughts or concerns, please reach out to my office at h1@iga.in.gov.